Business Basic Checking

-Sole Proprietor

| Minimum to Open | $100 |

| First 100 Transactions* | FREE |

| Each Additional Transaction* | $.25 |

Business Small Checking

| Minimum to Open | $100 |

| Monthly Fee | $10 |

| First 200 Transactions* | FREE |

| Each Additional Transaction* | $.25 |

Business CommercialChecking

-Corporation, Partnership, LLC

| Minimum to Open | $1,000 |

| Monthly Fee | $10 |

| Each Check Paid | $.15 |

| Each Deposited Item | $.10 |

| Each Deposit | $.10 |

| Each ACH Item | $.05 |

Earnings credits available based on average daily collected balance–credits offset per item fees.

Business Interest Checking

| Minimum to Open: $2,500 | |

| Tiered Rates based on daily collected balance | |

| $150,000 or more | Tier 1 |

| $100,000-$149,999.99 | Tier 2 |

| $50,000-$99,999.99 | Tier 3 |

| $5,000-$49,999.99 | Tier 4 |

| $4,999.99 or less | No interest paid |

Interest compounded monthly and paid monthly.

Diamond Money Market Account

| Minimum to Open: $2,500 | |

| Tiered Rates based on daily collected balance | |

| $500,000 or more | Tier 1 |

| $250,000 to $499,999.99 | Tier 2 |

| $100,000 to $249,999.99 | Tier 3 |

| $50,000 to $99,999.99 | Tier 4 |

| $2,500 to $49,999.99 | Tier 5 |

| $ 2,499.99 or less | No Interest Paid |

*Interest compounded monthly & paid monthly. $10.00 Monthly Service Fee if balance* falls below $2,500. An excessive debit charge of $10 per withdrawal will apply after 6 withdrawals in a statement cycle excluding loan payments made from this account to loans you have at Bank & Trust Company. *Average daily collected balance during statement cycle

Cash Management Services

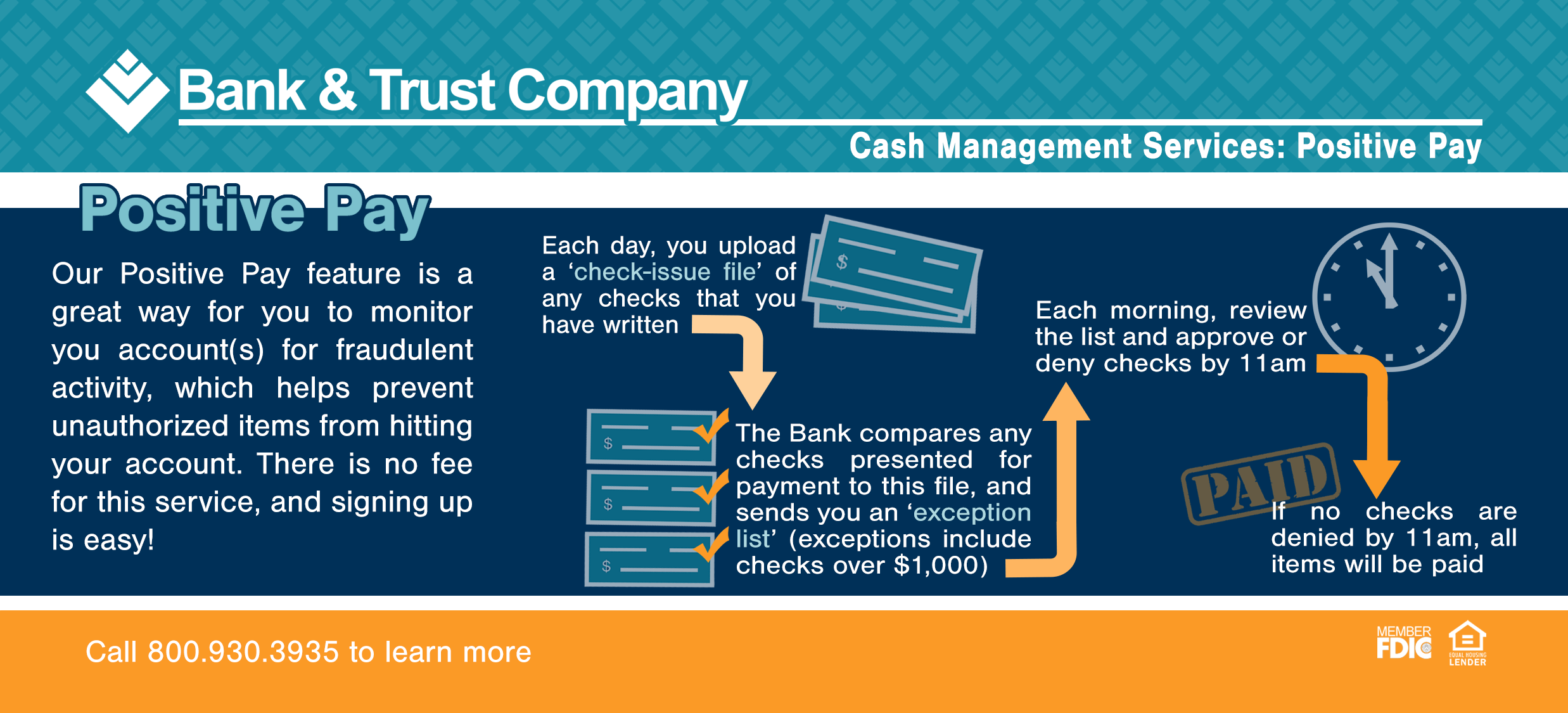

Positive Pay

Allows business customers to upload files of checks they write from their account and compare that file to checks clearing their account daily.

When an item is marked as an exception, the business customer makes the decision to either pay the item or return it unpaid because it did not match the issued file.

Remote Deposit Capture

Business Remote Deposit Capture allows you to deposit checks from the comfort of your office.

Scan checks into digital images using a provided check scanner & transmit them electronically to the Bank.

ACH Origination

Allows business owners to pay employees with direct deposit. Corporate Payments ACH Origination can also allow business owners to pay vendors electronically or to collect recurring payments from their customers such as rent or gym fees.

Autobooks

Designed for the small business, Autobooks is an easy-to-use online accounting platform. Create an Autobooks account thru our digital banking. Send invoices, accept payments, & pay your own bills online. Integrates with your Business Checking Account, streamlines incoming and outgoing payments in one place, & generates cash flow reports to simplify bookkeeping.

- Create an Autobooks Account within B&T Digital Banking

- Customize invoices, payment forms, etc. for your business

- Generate links to invoices & send by text, email, etc. AND/OR Accept payments in person thru the Autobooks app on your smartphone

- Payments will be deposited directly into your Business account