Quick Help

To report a lost or stolen card, follow these steps:

Call Us Immediately: Contact Bank & Trust Company as soon as you realize your card is lost or stolen by calling our customer service number at 800-930-3935. Our customer service representative might ask you security questions to verify your identity. After business hours call (800)-264-4274, then choose option 3.

Turn Off Your Card: If you use mobile banking, please turn off your card through the app. If you do not use mobile banking, our bookkeeping team will take care of this for you.

Monitor Your Account: Keep an eye on your account for any unauthorized transactions and report them immediately.

Turn your debit card on or off in real-time through the Bank & Trust Company app. Go to the main menu, select “Documents & Settings”, choose “Manage Cards”, then tap the button to turn the card on or off to stop any point-of-sale charges or ATM withdrawals. This will not affect any recurring or monthly charges you have linked to your debit card. It will help combat fraud.

Find other Bank & Trust Company locations or in-network ATMs right in the B&T app. Tap “Locations” at the bottom of the screen, then tap any location for more information. Search for an in-network ATM using the link directly under the map at the top of the location page. Additionally, we are a proud member of both the AlphaLink and MoneyPass ATM networks, offering you even more convenient access to no-surcharge ATMs nationwide.

Call Us Immediately: Contact Bank & Trust Company as soon as you realize you have fraudulent transactions on your card by calling our customer service number at 800-930-3935. Our customer service representative might ask you security questions to verify your identity. After business hours, call (800)-264-4274, then choose option 3.

"Have You Heard About" . . . provided by the FTC

Here’s how they work:

You get a call, email, text, or message on social media that looks like it’s from a business you know. It says there’s a problem with your account, or you won a prize. It tells you to call a number or click a link.

But the message isn’t really from a familiar business, it’s from a scammer. If you call, they’ll tell you to send payment or give personal information. They’ll say you must pay with gift cards, cryptocurrency, or by wiring money, which no honest business will do. Or they’ll ask for your Social Security number or access to your computer.

But it was never really that business contacting you, there wasn’t a problem, and there was never a prize.

Here’s what to do:

- Stop. If you get an unexpected call, email, text, or message on social media–even if it looks like it’s from a business you know–don’t click any links. And don’t call phone numbers they give you. These are often scams.

- Pass this information on to a friend. You may not have gotten one of these messages, but chances are you know someone who has.

Here’s how it works:

Someone contacts you asking for a donation to their charity. It sounds like a group you’ve heard of, it seems real, and you want to help.

But how can you tell what’s a scam? Charity scammers want to get your money quickly. They often pressure you to donate right away. They ask for cash, gift cards, cryptocurrency, or wire transfers. Scammers often refuse to send you information about the charity. They won’t answer questions or explain how the money will be used. They might even lie and say you already made a pledge to donate.

Here’s what to do:

- Take your time. Don’t trust your caller ID. Scammers use technology to make any name or number appear on caller ID. Tell callers to send you information by mail. Do some research. Is the charity real? If callers ask you for cash, gift cards, cryptocurrency, or a wire transfer, it’s a scam.

- Pass this information on to a friend. Probably everyone you know gets charity solicitations. This information could help someone else spot a possible scam.

Here’s how they work:

You get a call, email, or text message from someone who says they’re from the Social Security Administration or Medicare. They say something alarming — like your Social Security number has been suspended. Or maybe you’ll miss out on a government benefit. To fix it, they say you must pay, give them your personal information, or put your money on gift cards and read them the PIN numbers of the back of the cards.

The caller may know some of your Social Security number. And your caller ID might show a Washington, DC area code. But is it really the government calling?

No. The government doesn’t call people out of the blue with threats or promises of money. Caller IDs can be faked, so if you’re not sure, contact the agency at a phone number you know to be true (not the one they called you from).

Here’s what to do:

- Stop. Don’t send money to anyone who calls, emails, or texts and says they’re with the government. Don’t send them cash or pay them with gift cards, wire transfers, cryptocurrency or a payment app. The government won’t demand payment that way — and once you pay, it’s hard to get your money back. If you want to reach a government agency, find contact information at USA.gov.

- Pass this information on to a friend. You may not have gotten one of these calls, emails, or texts, but chances are, you know someone who has.

Here’s how they work:

You get a call: “Grandma, I need money for bail.” Or maybe an email from someone claiming to be your brother or a friend who says they’re in trouble. They need money for a medical bill. Or some other kind of emergency. The caller says it’s urgent — and tells you to keep it a secret.

But is the caller who you think it is? Scammers are good at pretending to be someone they’re not. They can be convincing: sometimes using information from social networking sites, or hacking into your loved one’s email account, all to make it seem more real. And they’ll pressure you to send money before you have time to think.

Here’s what to do:

- Stop. Check it out. Look up your family member’s phone number yourself and call another family member to check out the story.

- Pass this information on to a friend. You may not have gotten one of these calls, but chances are, you know someone who will get one — if they haven’t already.

Here’s how they work:

You get a call or see an ad offering you big discounts on health insurance. Or maybe someone contacts you out of the blue, says they’re from the government, and asks for your Medicare number to issue you a new card.

Scammers follow the news. When it’s Medicare open season, or when health insurance is a big story, scammers get busy contacting people. They want to get your Social Security number, financial account numbers, or insurance information.

Think about these questions. Is that discount insurance plan a good deal? Is that “government official” really from the government? Do you really have to get a new health insurance card? The answer to all three is almost always: No.

Here’s what to do:

- Stop. Check it out. Before you share your information, call Medicare (1-800-MEDICARE). Do some research, and check with someone you trust.

- Pass this information on to a friend. You probably know about these scams. But you might know someone who could use a friendly reminder.

Here’s how they work:

Someone knocks on your door or calls you. They say they can fix your leaky roof, put in new windows, or install the latest energy-efficient solar panels. They might find you after a flood, windstorm, or other natural disaster. They pressure you to act quickly and might ask you to pay in cash or offer to get you financing.

But here’s what happens next: they run off with your money and never make the repairs. Or they do shoddy repairs that make things worse. Maybe they got you to sign a bad financing agreement that puts your house at risk.

Here’s what to do:

- Stop. Check it out. Before making home repairs, ask for recommendations from people you trust and check that the companies have licenses and insurance. Get three written estimates. Don’t start work until you have reviewed and signed a written contract. And don’t pay someone who insists you can only pay with cash, a payment app, or wire transfers.

- Pass on this information on to a friend. You may see through these scams. But chances are, you know someone who could use a friendly reminder.

Here’s how it works:

Someone gets your personal information and runs up charges in your name. They might use your Social Security or Medicare number, your credit card, or your medical insurance — along with your good name.

Here are signs that someone is using your identity: You get bills for things you didn’t buy or services you didn’t use. Your bank account has withdrawals you didn’t make. You don’t get bills you expect. Or you check your credit report and find accounts you never knew about.

Here’s what to do:

- Protect your information. Shred documents before you throw them out, give your Social Security number only when you must, and use strong passwords online.

- Check your monthly statements and your credit. Read your account statements and explanations of benefits. Be sure you recognize what they show. Once a year, get your credit report for free from AnnualCreditReport.com or 1-877-322-8228. The law entitles you to one free report each year from each credit bureau. If you see something you don’t recognize, deal with it right away.

Here’s how they work:

You see an infomercial, or an ad online, saying you can learn how to make lots of money. It sounds quick, easy, and low risk — and it might involve investing in financial or real estate markets.

The company says their system is “proven” and they even have testimonials from people who’ve used their system and gotten rich. But those people could be paid actors and their reviews could be made up.

All investments have risks. No one can guarantee a specific return on an investment. And nobody can guarantee that an investment will be successful. Anyone who does promise you a guaranteed return at low or no risk is a scammer.

Here’s what to do:

- Stop. Take time to research the offer. Scammers want to rush you into a decision. Slow down. Search online for the name of the company and words like “review,” “scam,” or “complaint.”

- Pass this information on to a friend. You may not have gotten an offer like this, but chances are, you know someone who has.

Here’s how they work:

You see an ad saying you can earn big money, even working from home. Another ad offers help starting an online business — with a proven system to make money. Maybe you uploaded your resume to a job search website, and someone contacts you for an interview — but first, they want your driver’s license and bank account numbers.

If you respond to these opportunities to work from home, you’ll get requests for money — for training or special access — but you’ll never get the job. If you buy the proven system, you’ll get pressure to pay more for extra services. But you won’t get anything that really helps you start a business or make money. And if you give the caller your driver’s license and bank account numbers, they might steal your identity or your money.

Here’s what to do:

- Stop. Check it out. Never pay money to earn money. And don’t share personal information until you’ve done your research. Search online for the company name and the words “review,” “scam,” or “complaint.”

- Pass this information on to a friend. You probably know how to keep your money and information safe. But you may know someone who could use a friendly reminder.

Here’s how they work:

Someone contacts you on social media — and they’re interested in getting to know you. Or maybe you meet someone special on a dating website or mobile app. Soon the person wants to write to you directly or start talking on the phone. They say it’s true love, but they live far away — maybe because of work, or because they’re in the military.

Then they start asking for money. Maybe it’s for a plane ticket to visit you. Or emergency surgery. Or something else urgent.

Scammers of all ages, genders, and sexual orientations make fake profiles, sometimes using photos of other people — even stolen pictures of real military personnel. They build relationships — some even pretend to plan weddings — before they disappear with your money.

Here’s what to do:

- Stop. Don’t send money. Never send cash, or send money using gift cards, wire transfers, cryptocurrency, or a payment app to an online love interest. Once you pay this way, it’s hard to get your money back.

- Pass this information on to a friend. You may not have gotten tangled up with a romance scam, but chances are, you know someone who will — if they haven’t already.

Here’s how they work:

You get a call or message from someone who says they’re a computer technician. Or a number appears in a pop-up message on your screen. Or maybe you’re looking for tech support and call a number you find in a search engine. The person on the phone says they’re from a well-known company like Microsoft or Apple. And they tell you about viruses or other malware on your computer. Maybe they’ll ask you for remote access to your computer or say you must buy new software to fix it.

But are they someone you can trust? Judging by reports to the Federal Trade Commission, no. Tech support scammers will try to sell you useless services, steal your credit card number, or get access to your computer to install malware, which could then let them see everything on your computer (including your account passwords).

Here’s what to do:

- Hang up. If you get an unexpected call from someone saying there’s a problem with a computer — hang up, it’s a scam. If you need tech help, go to someone you know and trust — and call them at a phone number you know to be true (the ones that show up in your search engine aren’t always legit).

- Pass this information on to a friend. You might know these are scammers, but chances are, you know someone who doesn’t.

Here’s how they work:

You pick up the phone and hear a recorded message — a robocall — or a live person selling something. Maybe it’s not who your caller ID said it was. Or you get an unexpected text message saying you won a prize, have a package waiting, or must contact your bank.

Recorded sales calls are illegal unless you give a business written permission to robocall you. If your number is on the Do Not Call Registry, you’re not supposed to get any recorded or live sales calls. But scammers ignore the rules about when and how they can call you.

Scammers use technology to make any name or number show up on your caller ID: the IRS, a business you know, or even your own number. You can’t trust caller ID because phone numbers can be faked. Scammers send text messages to trick you into clicking links and giving personal information.

Here’s what to do:

- Hang up on unwanted calls and ignore unexpected texts. Don’t press any numbers or click on links. Blocking services might reduce unwanted calls and texts. Ask your phone carrier about call and message blocking. Read expert reviews about your options. Learn more at ftc.gov/calls.

- Pass this information on to a friend. You may know what to do about unwanted calls and texts, but you probably know someone who doesn’t.

Here’s how they work:

You get a call, letter, email, or text saying that you won! Maybe it’s a vacation or cruise, a lottery or a sweepstakes. The person calling about your prize is so excited. They can’t wait for you to get your winnings.

But here’s what happens next. They say there are fees, taxes, or customs duties to pay. Then they ask for your credit card number or bank account information. Or they insist you can only pay with cash, gift cards, wire transfers, cryptocurrency, or a payment app.

If you pay a scammer or share information, you lose. There is no prize. Instead, you get more requests for money, and more false promises that you won big.

Here’s what to do:

- Keep your money — and your information — to yourself. Never share your financial information with someone who contacts you and claims to need it. And never pay anyone who insists you send cash or can only pay with cash, gift cards, wire transfers, cryptocurrency, or a payment app.

- Pass this information on to a friend. You probably ignore these kinds of scams when you see or hear them. But you probably know someone who could use a friendly reminder.

Direct Deposit & Transactions/Payments

Send funds person-to-person (or P2P) within the Bank & Trust Company app. Fill in the name, choose a payment method, and then add the pertinent information. Choose “Transfers” at the bottom of the screen, then “My Payees” at the top right. Tap the “+” sign to add a new payee, then select “Person-to-Person”. (If you don’t see P2P call us to activate this function.) The payee will be contacted by the method you choose to accept the payment. After they respond they will appear here as an available transfer recipient.

Direct deposit can be established with most employers and government agencies as well as pension funds. Please provide Bank & Trust Company’s routing number (081903537) and your account number to your employer/agency. Our customer service representatives will be happy to assist you in finding your account number.

Set up recurring transfers between accounts or loan payments within the Bank & Trust Company app. Select “Transfers” from the bottom of the screen, tap “New Transaction”, and select the account to transfer funds from, then select the recipient account. Enter the amount, the date to begin the transfer, the occurrence frequency, and add a note if desired. A summary will appear, and then you may submit. You can edit or delete recurring transactions at any time.

You can transfer between Bank & Trust Company accounts, or make loan payments, all within the B&T app. Go to the main menu and select “Pay, Transfer, and Receive”, then choose “Move Money” or you can select “Transfers” from the bottom of the screen. Tap “New Transaction”, select the account to transfer funds from, then the recipient account, then enter the amount, date of transfer, occurrence frequency, and add a note if desired. A summary will appear and then you may submit.

Bill Pay is an added service that Bank & Trust Company provides. There is a cost of $4.95 ($7.95 for business accounts) a month, though some account types receive Bill Pay at no charge. Call 800.930.3935 to speak to a Customer Service Representative if you are interested in learning more!

Generally, branch transactions processed prior to 4:00 P.M. Monday through Friday will post to your account that same day. (Some branch locations may have a different cut-off time.) Debit transactions vary by merchant.

Find other Bank & Trust Company locations or in-network ATMs right in the B&T app. Tap “Locations” at the bottom of the screen, then tap any location for more information. Search for an in-network ATM using the link directly under the map at the top of the location page. Additionally, we are a proud member of both the AlphaLink and MoneyPass ATM networks, offering you even more convenient access to in-network ATMs nationwide.

To deposit a check using Mobile Check Deposit, log in to your Bank & Trust Company mobile app. From the main page, click the menu at the bottom left of the screen. Under the “Pay, Transfer, and Receive” section, select “Deposit Checks.” Make sure your check is endorsed with “For Mobile Deposit Only” beneath your signature. You will be prompted to choose a deposit account, take photos of the front and back of the check, and enter the check amount. If you have additional checks, you can add them by following the same process. Once all checks are ready, hit “Submit” to complete the deposit.

General

Bank & Trust Company is an FDIC Member, meaning FDIC insurance covers deposits up to $250,000 per depositor, per ownership category, per FDIC-insured bank. To find out specific information visit the Federal Deposit Insurance Corporation’s website and use their handy EDIE calculator.

In 2025, Bank & Trust Company will be closed on the following holidays: New Year’s Day on January 1, Martin Luther King Day on January 20, President’s Day on February 17, Memorial Day on May 26, Juneteenth on June 19, Independence Day on July 4, Labor Day on September 1, Columbus Day on October 13, Veterans Day on November 11, Thanksgiving Day on November 27, and Christmas Day on December 25. Additionally, please note that the bank will be closing early at 12 PM on Christmas Eve (December 24) and 3PM on New Year’s Eve (December 31).

Bank & Trust Company’s routing number is 081903537.

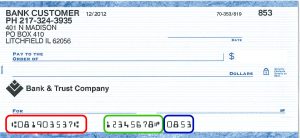

The picture below is of a sample check. The routing number (circled in red on the sample) is usually on the bottom-left of the check. The account number (circled in green) is usually next, and the number to the far-right (circled in blue) is the check number.

Bank & Trust Company offers a variety of accounts to suit your needs, including savings accounts, checking accounts, certificates of deposits (CDs), retirement accounts (IRAs), and Christmas Clubs. For more information on which account is right for you, please call 800.930.3935 and speak with a customer representative or stop by your nearest branch.

Our main location is in Litchfield, where we have two branches to serve you better. In addition to our main branches, Bank & Trust Company is proud to serve the community with branches in several other locations, including Carlinville, Chatham, Coffeen, Farmersville, Fillmore, Irving, Raymond, Rochester, and Witt. For more information please view “Our Locations” page.

Loans

At Bank & Trust Company, you cannot apply for a loan directly online. However, you can print out a loan application from our loans page on our website and submit it to your nearest branch. Our team will ensure that your application is forwarded to the loan officer best suited to help you achieve your financial goals. If you need assistance with the application process or have any questions, our branch staff is here to help.

Loan payments can be made in various ways, including online through our banking site or app, via automatic debit from your account, by mail, or in person at any of our branches. However, please note that the final payment on your loan cannot be made through these methods. For the final payment, you will need to visit one of our branches in person to complete the process.

Loan approval times can vary depending on the type of loan and your financial situation. Generally, you can expect a decision within a few business days after submitting all necessary documentation.

The documents required vary depending on the type of loan. Typically, you will need identification, proof of income, and details about the collateral (if applicable). Our loan officers can provide a detailed list based on your specific loan application.

Bank & Trust Company offers a comprehensive range of loan products designed to meet your personal and business financial needs. For individuals, we provide auto loans for purchasing new or used vehicles, home equity lines of credit and home equity loans for leveraging the value of your home, mortgage loans for buying or refinancing your home, construction loans for building new properties, and personal loans for various financial needs.

For businesses and agricultural clients, we offer specialized solutions, including business loans, commercial real estate loans, letters of credit, and our Bank & Trust Company Business Line of Credit. We also provide USDA Rural Development Loans, farm real estate loans, livestock loans, farm machinery and equipment financing, and farm operating loans, tailored to support agricultural operations and rural development.

Our team is here to help you find the right loan option tailored to your specific requirements. Whether you’re an individual seeking a personal loan or a business owner looking to expand, we are committed to your success.

Mobile Banking

To change your Bank & Trust mobile app security questions, first log in to the mobile app with your credentials. Once logged in, navigate to the “Profile” icon at the bottom right of the screen. Under the “Login Settings” section, click on “Change Security Questions.” Here you can select new security questions, enter your new answers, and then submit them. Finally, make sure to hit “Save” to ensure your changes are updated in the system.

To reset your debit card PIN number within the Bank & Trust Company app go to the main menu and select “Documents & Settings”, then select “Manage Cards”. Tap a card and select “Change Pin”. Enter the new PIN twice, then submit. You will need to verify that it’s you for the new PIN to be accepted, either by password or by multi-factor authentication.

You can easily raise your debit card limit by calling your local branch. A Customer Service Representative will be happy to help!

You can name, reorder, and hide accounts within the B&T app. Choose manage profile at the top of the main menu, then scroll down to application settings. Choose any options to make changes to your account view and make the mobile banking experience tailored to you.

Go to the main menu, and select “Documents and Settings”, then select “Manage Cards”. Tap a card, select “Travel Notifications” from the menu, add your travel locations and dates, then submit.

To use mobile banking, click here, scroll to the “Mobile Banking” section, and download the app using the QR code, or by searching your app store for Bank & Trust Company. Then install, open, and follow the directions. (If you have online banking, you can use your online banking username/password to access your accounts through mobile banking.)

Turn your debit card on or off in real-time through the Bank & Trust Company app. Go to the main menu, select “Documents & Settings”, choose “Manage Cards”, then tap the button to turn the card on or off to stop any point of sale charges or ATM withdrawals. This will not affect any recurring or monthly charges you have linked to your debit card. It will help combat fraud

Mobile banking allows you to conduct banking transactions using your mobile phone. You can conduct most any of the transactions available through online banking using your mobile phone, including Bill Pay if you’re enrolled in that feature.

Online Banking

If you have signed up for online banking and opted to receive digital statements, your statements will be viewable when you log in. You can find the statements under “Documents & Settings” under the main menu, then select “Documents”, and choose “Statements” as the document type.

Please contact a Customer Service Representative by calling 800.930.3935.

To pay your bills online, you must first be an online banking customer. While there is a $4.95 monthly fee, our DiamondPlus customers receive this option as part of their enrollment. Log in to online banking, click on the “Bill Pay” link, and fill out the application. You’ll be notified of your acceptance. Then, you must add your payees: to add a payee, you will need the payee’s name, address, phone number and the billing account number.

If you forget your online banking password, follow these steps to reset it:

- Visit the Login Page: Go to the Bank & Trust Company online banking login page.

- Click on ‘Forgot Password’: Look for and click the ‘Forgot Password’ link or button.

- Verify Your Identity: You will be prompted to answer a security question to verify your identity.

- Reset Your Password: Follow the instructions to create a new password.

- Log In: Once your password has been reset, you can log in to your online banking account with your new password.

If you encounter any issues or need further assistance, please contact our customer service team for help.

Security

- Never provide your personal information in response to an unsolicited request.

- If you believe the contact may be legitimate, hang up, and verify by contacting the financial institution directly.

- Never provide your password over the phone or in response to an unsolicited Internet request.

- Review account statements regularly to ensure all charges are correct.

To report a suspicious email or phone call, please follow these steps:

Do Not Respond: Avoid clicking on any links or providing personal information if you suspect the communication is fraudulent.

Verify Contact: If you are unsure whether a communication is genuinely from Bank & Trust Company, call us directly at 800.930.3935 to verify if we are trying to contact you.

Call Us Immediately: Contact Bank & Trust Company as soon as you realize you have fraudulent transactions on your card by calling our customer service number at 800.930.3935. Our customer service representative might ask you security questions to verify your identity. After business hours, call (800).264.4274, then choose option 3.

Please, notify us right away. The FTC has provided an Identity Theft Recovery Guide to help you take the necessary precautions. Also, if you are a DiamondPlus Checking account holder, contact BaZing and enlist the help of their ID theft specialists.

Trust & Wealth Management

For more information about our trust and wealth management services, please visit our designated Wealth Management & Trust page or contact Denise Shrewsbury-DeLaCruz or Roger Krabbe. They will be happy to assist you and provide further details about our offerings.

To be considered for a bequest, you need to fill out the application provided for the specific trust you’re petitioning. Ensure you submit the required number of copies and provide proof of your organization’s qualification as a charitable organization under the Internal Revenue Code.